Almost every potential borrower recognizes the positives that come with taking out a loan without credit checks. If you’re new to this, well, no credit check loans are beneficial in the sense that they do not negatively impact your credit score. They also enable you to find out your credit profile without alerting lenders or regulators.

With no credit check loans, you can attract loan offers with an easy application process, a low interest rate, and incredibly low fees. However, one popular question among intending borrowers is whether they may qualify for no credit check loans if they have a bad credit score.

We answer this question and more in this article. You’ll also get insights into how you can request quotes for no credit check loans from reputable brokers like WeLoans.

What Credit Score is Best for Online Loans?

People have varying credit scores, and there is no single credit rating that is the best for receiving online loans. The “best” credit score for online loans can vary depending on the lender and the type of loan you’re seeking.

In general, a credit score of 700 or higher is considered good, and a score of 750 or higher is considered excellent. However, some online lenders may have different credit score requirements or may consider other factors in addition to your credit score when evaluating your loan application.

On the flip side, some lenders may even place a lower emphasis on your credit score and more consideration on your employment status and source of income. In cases like this, your credit score does not matter as long as you can demonstrate an ability to repay the loan you’re taking.

Can I Get No Credit Check Loans With Bad Credit?

It is possible to find lenders that offer no credit check loans, but these loans may not be suitable for everyone, particularly if you have bad credit. Caroline Banton, one of WeLoans’ expert financial writers, commented that lenders that offer no credit check loans may not consider your credit history when deciding whether to approve your loan, but they may still require you to meet other qualifications, such as having a stable income or a co-signer.

No credit check loans may also come with higher interest rates and fees than loans from lenders who do check your credit. This is because many no credit check loans carry higher risk. Additionally, these loans may not be available in all states, as some states have laws that regulate or prohibit no credit check loans.

If you have bad credit, you can find no credit check loans on the page of WeLoans. There, you’ll find different funding options suitable to bad credit borrowers. However, most of these offers come from lenders that may request additional requirements and perform a soft pull on your credit before approving your loan.

Factors to Consider Before Taking a Bad Credit Loan Without a Credit Check

Before going ahead to apply for a bad credit loan, here are some factors you’ll like to consider as a bad credit borrower.

Loan Terms

In general, the loan terms include the interest rates, fees, and length of repayment. No credit check loans may come with higher interest rates and fees than loans from lenders who do check your credit. This can make the loan more expensive in the long run. Also, you should consider the repayment term and frequency of payments to determine if it is comfortable. If not, you should look elsewhere.

Pre-Qualification

Some lenders require pre-qualification before giving you loans. If such a lender performs a hard credit check, it can significantly affect your credit score negatively. While it may be good to get pre-qualified before applying for a loan, especially since it helps you understand the rates, you need to be careful. If not, you may find yourself worsening your credit score.

Co-Signer

Many no credit loans either require proof of income or make it necessary for you to use a co-signer. A co-signer is someone who agrees to take on the responsibility of repaying the loan if you are unable to do so. If your loan offer includes a co-signer, you need to make sure you are able to repay on time. This way, you’ll avoid causing problems for your co-signer.

Compare Multiple Choices

No credit check loans may come with higher interest rates and fees than other personal loans, so it’s important to compare offers from multiple lenders and try to find a loan with a low APR and minimal fees. Keep in mind that no credit check lenders may only offer small loan amounts, typically ranging from a few hundred to a few thousand dollars. It’s important to find a lender that can provide the amount of funding you need for your expenses.

Alternative Funding Options

No credit check loans aren’t the only option available to you as a bad credit borrower. Before taking a no credit check loan, consider other options that may be available to you, such as working with a credit union or finding a lender that is willing to work with borrowers with less-than-perfect credit.

Recommended Places to Get No Credit Loans With a Bad Credit Score

If, after considering all necessary factors, you make a final decision to opt for no credit check loans, here are places to get loans with relatively good terms.

- Credit Unions: Some credit unions may be more willing to work with borrowers who have bad credit or limited credit history. Credit unions are nonprofit organizations that offer financial services to their members, and they may have more flexible lending criteria than banks.

- Online lenders: There are a number of online lenders that offer personal loans to borrowers with bad credit. These lenders may not check your credit as part of the loan application process, but they may still have other eligibility requirements that you must meet.

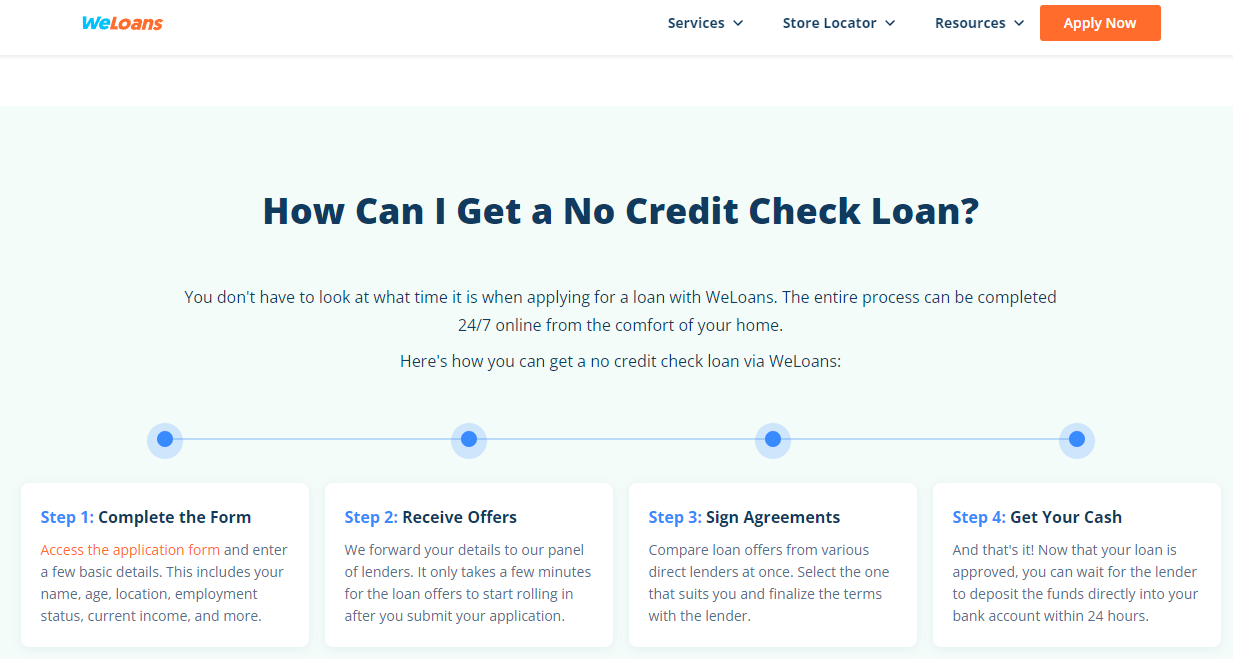

- Brokers: Brokers work hand-in-hand with lenders to bring loan offers closer to you. Companies like WeLoans allow you to request quotes on their website and send your details to multiple lenders. In turn, you’ll get different offers that you can compare and choose from.

Concluding Remarks

No credit check loans are a good way to avoid the negative impacts of a hard credit check. But if you decide to take one, you should make sure you’re extremely careful. That’s because most no credit check loans come with additional requirements. If you do not meet these criteria, it is advisable to seek out other funding alternatives.